In this article, I will share with you how radical transparency and algorithmic decision-making is a way to create a company where the best ideas win. And these principles aren’t limited to companies or the workplace alone. They are perfect for creating families other relationships where the best ideas win.

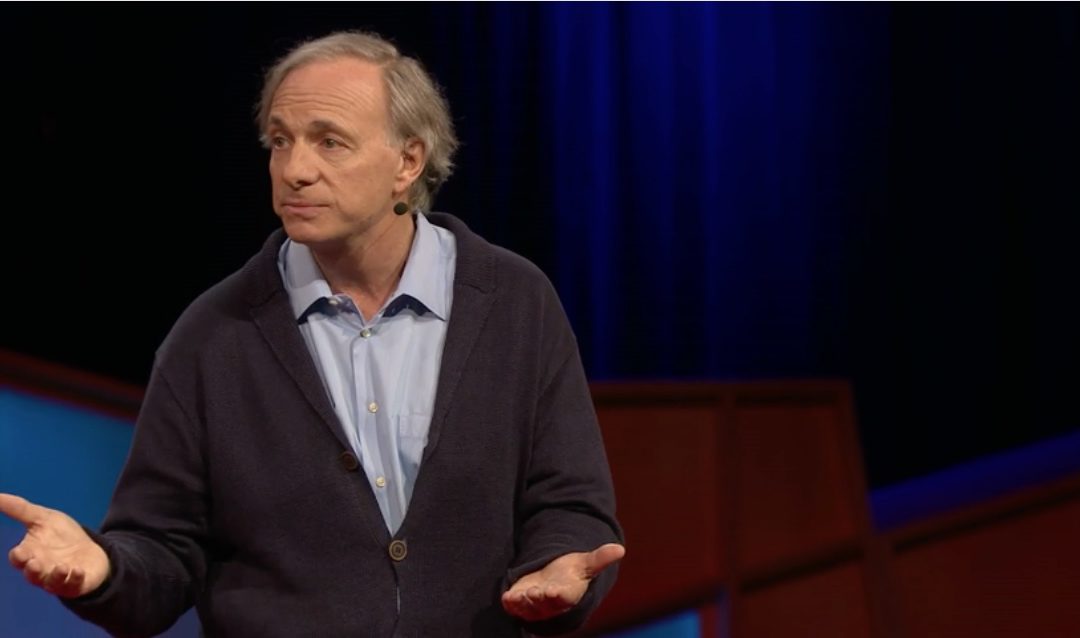

Let me introduce you to Ray Dalio, the founder, and CEO of Bridgewater Associates, a global leader in institutional portfolio management and the largest hedge fund in the world. Recently, I listened to Mr. Dalio talk about how his company successfully made idea meritocracy part of its culture and how that has produced amazing results for them. I think that the approach he has taken to create idea meritocracy in his company is at the heart of building not only a great company but also great relationships and a great life.

Below I share some excerpts from the presentation. I have put Mr. Dalio’s words in quotation marks and I have added comments to provide context.

Mr. Dalio says:

“My objective has been to have meaningful work and meaningful relationships with the people I work with, and I’ve learned that I couldn’t have that unless I had that radical transparency and that algorithmic decision-making.”

Mr. Dalio, who works as an investor and runs a hedge fund, continued,

“In order to be an effective investor, one has to bet against the consensus and be right. And it’s not easy to bet against the consensus and be right. One has to bet against the consensus and be right because the consensus is built into the price. And in order to be an entrepreneur, a successful entrepreneur, one has to bet against the consensus and be right. I had to be an entrepreneur and an investor — and what goes along with that is making a lot of painful mistakes. So I made a lot of painful mistakes, and with time, my attitude about those mistakes began to change. I began to think of them as puzzles. That if I could solve the puzzles, they would give me gems. And the puzzles were: What would I do differently in the future so I wouldn’t make that painful mistake? And the gems were principles that I would then write down so that I would remember them. That would help me in the future.”

He goes on and shares one of his greatest mistakes. In the 1970s, he was a smart and arrogant young stockbroker who thought he knew everything. He made one huge prediction about the economy that came true. That launched him onto national television with multiple interviews. He was claiming that he understood exactly how the economy worked. He was even invited to testify before Congress. Then because of poor decision-making from being too self-confident in his own knowledge and abilities, his financial bets went south and he went bankrupt. He even had to borrow money from his family to pay his bills.

Here is how he talks about the event:

“It was one of the most painful experiences of my life … but it turned out to be one of the greatest experiences of my life because it changed my attitude about decision-making. Rather than thinking, “I’m right,” I started to ask myself, “How do I know I’m right?” I gained a humility that I needed in order to balance my audacity. I wanted to find the smartest people who would disagree with me to try to understand their perspective or to have them stress test my perspective. I wanted to make an idea meritocracy. In other words, not an autocracy in which I would lead and others would follow and not a democracy in which everybody’s points of view were equally valued, but I wanted to have an idea meritocracy in which the best ideas would win out. And in order to do that, I realized that we would need radical truthfulness and radical transparency.”

“What I mean by radical truthfulness and radical transparency is people needed to say what they really believed and to see everything. And we literally tape almost all conversations and let everybody see everything because if we didn’t do that, we couldn’t really have an idea meritocracy. In order to have an idea meritocracy, we have let people speak and say what they want.”

In his company, everything that has to do with the business is an open book. Even though he is the founder and CEO of his company, everything is published for everyone to see including negative comments from the most junior staff about his performance. And that kind of transparency is not only tolerated, it is encouraged.

His company uses a computer system and an algorithm that collects data on people’s views and helps them make better decisions. It also helps them know what people are like.

Mr. Dalio says, “Knowing what people are like also allows us to decide what responsibilities to give them and to weigh our decisions based on people’s merits. We call it their believability.” He shares an example of an instance where all his team members, both experienced and inexperienced had to vote yes or no on a project.

When everybody’s vote was counted with equal weight (i.e. one person to one vote), the results came out 77% saying YES and 23% say NO. In this democratic 1 person has 1 vote scenario, the secretary would have one vote as the CEO of the company even though their experience is vastly different. The experienced physician would have the same vote as the certified nurse’s assistant about whether or not to pull the plug on someone who was in critical condition. The distinguished general of the army would have the same vote as a private about whether to go to war with another country or not.

But when they weighed the views based on people’s merits, the answer was completely different. The new results were 19% saying YES and 81% saying NO. You see that even though the majority was saying yes to a particular deal, because they had less experience, less merit, and less believability, the computer algorithm actually converted what would have been an overwhelming YES to the reverse, an overwhelming NO by considering the merits of the people voting. “This process allows us to make decisions not based on democracy, not based on autocracy, but based on algorithms that take people’s believability into consideration.”

Related article: Meritocracy – Why you should use it to select those you work with

“We do it because it eliminates what I believe to be one of the greatest tragedies of mankind, and that is people arrogantly, naïvely holding opinions in their minds that are wrong, and acting on them, and not putting them out there to stress test them. And that’s a tragedy. And we do it because it elevates us above our own opinions so that we start to see things through everybody’s eyes, and we see things collectively. Collective decision-making is so much better than individual decision-making if it’s done well. It’s been the secret sauce behind our success. It’s why we’ve made more money for our clients than any other hedge fund in existence and made money 23 out of the last 26 years.”

Click here if you want to listen to Mr. Dalio’s entire presentation.